Major Milestone: CFPB Issues Advanced Notice of Rulemaking on Coerced Debt, Addressing Systemic Barriers to Safety for Domestic Violence Survivors

FOR IMMEDIATE RELEASE | Date: 12/9/2024

Contact: Center for Survivor Agency & Justice, Erika Sussman (erika@csaj.org)

Washington, DC – Today, the Consumer Financial Protection Bureau (CFPB) granted the petition submitted by the Center for Survivor Agency and Justice and the National Consumer Law Center (NCLC) for rulemaking on coerced debt by issuing an advance notice of proposed rulemaking, marking a monumental milestone in over a decade of collective advocacy efforts. This achievement sets the stage for transformative changes in financial protection for survivors of domestic violence.

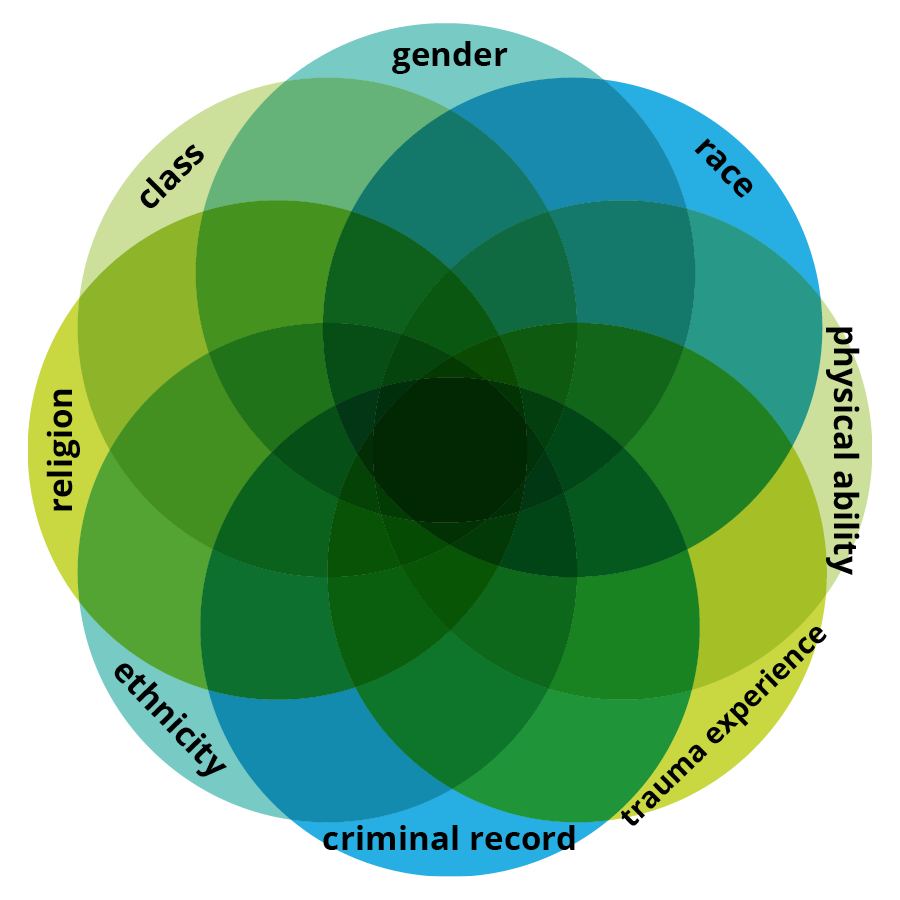

Coerced debt is a form of economic abuse where an abusive partner uses, exploits, and/or damages credit for their own advantage and to restrict survivors’ agency. Research shows that nearly all survivors experience some form of economic abuse (94-99%), and half report experiencing coerced debt (Adams et al., 2008).

“For almost two decades, advocates, attorneys, and survivors have identified coerced debt as the most formidable barrier to safety. Coerced debt creates an economic ripple effect that compounds over the life course, creating financial devastation and placing survivors at increased risk of violence,” stated CSAJ’s Executive Director and Founder, Erika Sussman. “For too long, our consumer financial system has placed the burden of addressing coerced debt on individual survivors, penalizing survivors for their own victimization, and holding them responsible for debt that is not their own. With its notice of rulemaking, the CFPB has taken a powerful step forward in addressing this systemic abuse, opening pathways to economic security and physical safety for survivors across the nation.”

Beyond the hard costs, coerced debt creates a cascade of consequences by damaging credit and thus restricting access to housing, employment, and other resources that are critical to one’s safety. Katie VonDeLinde, a Women’s Health Advocate for the AWARE Program at Barnes Jewish Hospital, highlighted these consequences: “Everyday, survivors are denied housing and access to credit that impacts their families’ crucial safety needs as a result of credit abuse by a former partner. This possibility of key rule making changes gives hope to survivors and advocates around the country.”

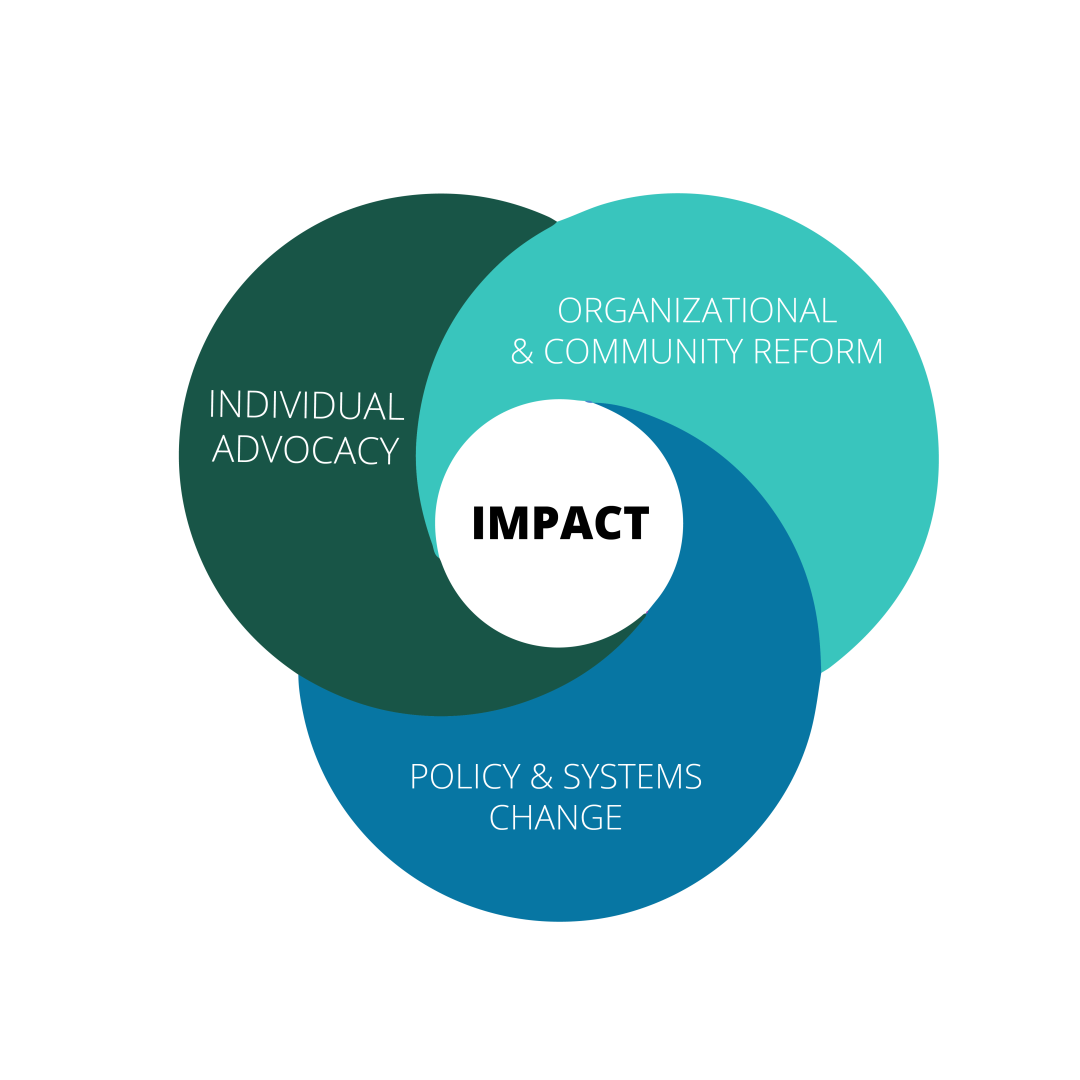

This progress would not have been possible without the contributions of the Coerced Debt Working Group (CDWG). Organized by CSAJ, the CDWG consists of over three dozen attorneys, advocates, researchers, policy makers across the nation who bring diverse expertise and practice at the intersection of consumer rights and gender based violence to organize for systems and policy change.

“Researchers, service providers and advocates have demonstrated the long-lasting and devastating impacts of financial abuse and coerced debt on survivors and their families,” DV-Consumer Staff Attorney at the Legal Aid Society and Co-Chair of the New York City Domestic Violence & Consumer Law Working Group, Claire Mooney stated. “The rule making announced by the CFPB presents a historic opportunity in creating federal policy that acknowledges and addresses financial abuse to enable survivors to achieve economic self-sufficiency.”

The Working Group’s comments in support of the petition told real and compelling stories of how survivors are impacted by coerced debt. Financial abuse and coerced debt have long-term consequences and due to systemic challenges that survivors face, can feel insurmountable to recover from. Ann Baddour, Director of the Fair Financial Services Project at Texas Appleseed spoke on this sharing “Victims of financial abuse are often left holding debts incurred by abusers and spend years of their lives struggling to deal with these debt burdens,” Baddour stated. “If this important rule making is completed, it will be a monumental shift, empowering survivors to take steps towards financial recovery.”

The debt burdens Baddour speaks of are staggering. According to a study conducted by Professor Adrienne Adams, of Michigan State University, and Sara Wee, Director of Research at CSAJ, 50% of survivors have debt loads of up to $20,000, 23% over $20,000, and 26% do not know how much debt they have accumulated. Adams provided additional context and shared “Research has shown that coerced debt is a common and expensive problem for survivors, and advocates have worked tirelessly to prevent, interrupt, and remedy it. This rulemaking process has the potential to make a significant difference in survivors’ lives as they work to recover from the financial harms of an economically abusive relationship.”

As we move forward with this victory, CSAJ is committed to working with partners, policymakers, and advocates to ensure that the CFPB’s rulemaking translates into real, lasting change for survivors. We are grateful for our long-time partners at NCLC who have tirelessly worked alongside CSAJ to advocate for economic justice. “We applaud the CFPB’s efforts to address the devastating financial harm caused by coerced debt and seek public input on ways to help survivors of financial abuse,” shared Andrea Bopp Stark, Staff Attorney at NCLC.

Comments regarding coerced debt are encouraged and due to the CFPB by March 7, 2025.

Thank you for helping us celebrate and mobilize around this meaningful moment. If you have questions or would like any additional information as we amplify this achievement and organize for impactful rulemaking, please reach out.

Citation’s and Related Resources:

- CSAJ and NCLC Petition the CFPB for FCRA Rulemaking on Coerced Debt

- Compendium on Coerced Debt (CSAJ, 2023)

- Consumer Rights Newsletter on Coerced Debt (CSAJ, 2023)

- Development of the Scale of Economic Abuse (Adams et al., 2008)

- Survivors Economic Wellbeing, Debt Burden – National Snapshot (Adams & Wee, 2019)

###

The Center for Survivor Agency and Justice is a national nonprofit organization that advances economic equity for survivors of gender based violence, by building the capacity of advocates and attorneys, strengthening organizational and community responses, and fueling systems and policy change. To learn more about our work, visit https://csaj.org