Consumer Rights for Domestic & Sexual Violence Survivors Initiative

Newsletter on Economic and Consumer Rights for Immigrant Survivors Part 1

Introduction

CSAJ’s Consumer Rights Newsletters share multi-level strategies by and for the field on critical consumer and economic issues that impact survivors’ safety. In this edition, we are featuring several resources, recent events/conferences and policy updates on economic and consumer rights for advocates and attorneys who work with immigrant survivors. Section 1 of this newsletter shares a summary of the lessons learned from CSAJ’s Consumer Rights Legal Roundtable Series titled Economic and Consumer Rights for Immigrant Survivors of Domestic Violence held on April 19th 2024.

The Consumer Rights Newsletters are part of CSAJ’s Consumer Rights for Domestic and Sexual Violence Survivors Initiative, a national project that builds on the capacity of and builds partnerships between domestic violence and consumer (anti-poverty) lawyers and advocates.

Section 1: Landscape of Economic and Consumer Issues Immigrant Survivors are Facing

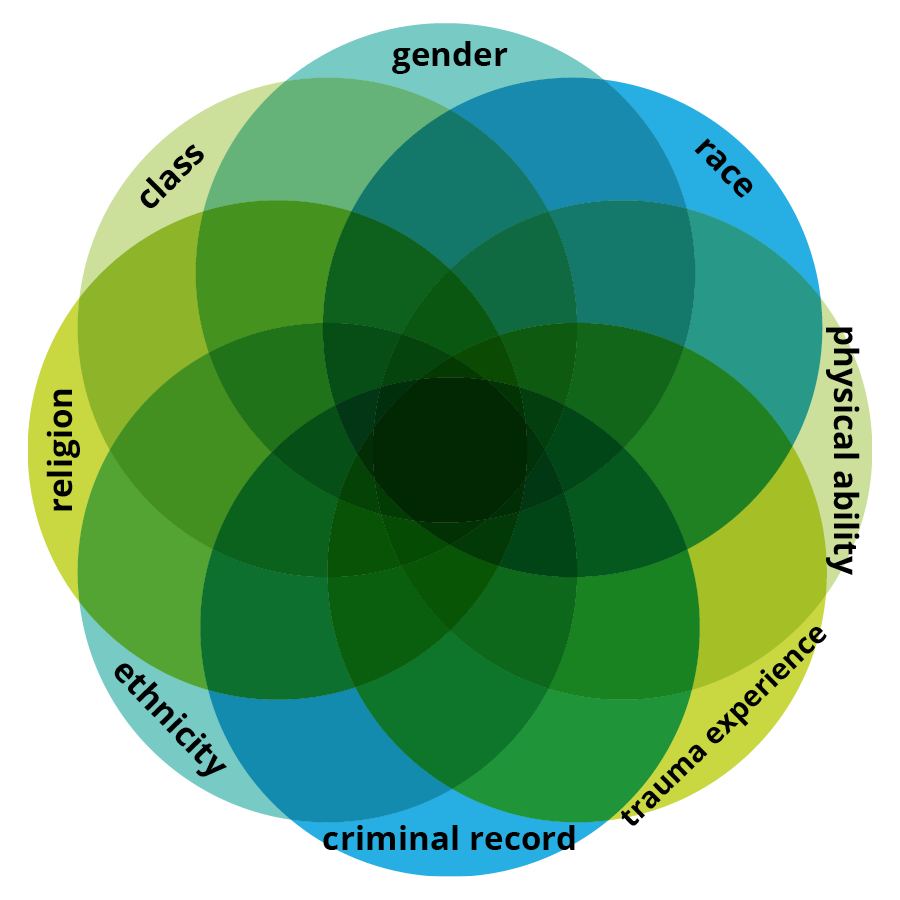

Immigrant survivors of domestic violence contend with numerous challenges– from adjusting to a foreign country, to dependent immigration status or lack of immigration status, to ineligibility for public assistance or fear of accessing public services due to the persistent chilling effect of the “public charge rule.” New to this country, many immigrant survivors lack an understanding of the US credit and financial system, making them particularly vulnerable to economic abuse and coerced debt. As a result, immigrant survivors face deep economic and consumer rights needs that are in need of creative, culturally relevant advocacy. Immigrant survivors of domestic violence face a multitude of economic and consumer challenges that significantly impact their safety and well-being. These challenges include:

1. Persistent Fear Surrounding the Public Charge Rule

One of the most significant issues is the pervasive fear related to the public charge rule. Despite recent reversals of restrictive changes, many immigrants remain uncertain about their current and future immigration status. This uncertainty deters them from seeking necessary economic assistance. Historically, the public charge rule has fluctuated, creating a climate of fear and confusion. Before 1999, there was considerable discretion in how field officers applied the rule, leading to inconsistent outcomes. The 2019 changes further exacerbated this fear, and although the Biden administration has reverted those changes, the trust among immigrant communities remains eroded.

2. Language Access Barriers

Language access is another critical barrier. Effective communication within legal and financial systems is often hindered due to inadequate language services. Immigrant survivors frequently struggle to access necessary legal and financial resources because organizations do not always have staff proficient in their languages. Ensuring that organizations have staff who are compensated for their language skills and advocacy efforts is essential for supporting survivors. Without proper language services, survivors face significant obstacles in understanding and exercising their rights, complicating their economic stability.

3. Economic Barriers in Accessing Banking Services

Accessing banking services presents significant economic barriers for immigrant survivors. Banks often require stringent identification verification processes, which many immigrants find challenging to navigate. There is also a risk of accounts being closed without notice, leaving survivors without access to their funds. Fraud is another prevalent issue complicating banking for immigrants. For instance, survivors may face identity theft, and when they seek help, they encounter further barriers due to language and procedural complexities. While consumer law provides some protections, these barriers highlight the need for more accessible and immigrant-friendly financial systems.

4. Impact of Fraud and Identity Theft

Fraud and identity theft are common issues that destabilize the financial situations of immigrant survivors. Reporting these issues effectively is often hampered by language barriers and a lack of awareness about their rights. Banks are required to provide language services, but many survivors report that these services are inadequate or inaccessible, exacerbating their financial challenges and making it difficult for them to recover from financial losses.

5. Creative Community Solutions

Despite these challenges, immigrant communities have developed creative solutions to advance economic and consumer justice for survivors. Examples include forming partnerships with banks to improve access to financial services, organizing community events such as art shows and yard sales to generate income, and creating lending circles where members pool money and take turns accessing the funds. These grassroots efforts demonstrate the resilience and resourcefulness of immigrant survivors in overcoming economic barriers.

6. Legal and Advocacy Support

Building strong relationships with local authorities and legal advocacy groups is crucial for supporting immigrant survivors. Ensuring that courts and other legal entities provide proper interpretation services is a critical step. Advocates can help survivors navigate complex legal and financial systems, offering guidance on issues such as public charge, credit building, and fraud prevention.

Immigrant survivors of domestic violence face multifaceted economic and consumer challenges. Addressing these issues requires a concerted effort to improve language access, make financial systems more inclusive, and support community-led initiatives. By understanding and addressing these barriers, we can create a more supportive environment for immigrant survivors to achieve financial stability and independence.

Section 2: Advocacy Resource

2.1 Individual advocacy: Credit Building for Survivors

Advocates can play a pivotal role in helping survivors rebuild their financial stability. One crucial area is credit building. Providing survivors with education and resources on credit repair can empower them to improve their financial health.

Advocates provide information, hope, and guidance for survivors who are trying to build or rebuild their credit after enduring economic abuse or living through financial repercussions of the abuse. Some survivors have no lines of good credit and want to build positive credit in order to increase their financial agency. Whatever the reason, you can use these tips when assisting survivors with credit building.

Tip #1: Understand the survivor’s relationship with credit and credit goals

- Ask questions to assess survivor’s values, safety, experiences, strengths and goals. This is the essential first step for all credit advocacy:

- How do you feel about credit in general?

- How is your safety impacted by your credit? Has your partner/ex partner impacted your credit? If so, how? Do you think your partner is monitoring your credit now?

- What do you do well when it comes to credit?

- What are some of your concerns when it comes to your credit?

- What have you tried in the past to build your credit? What worked? What goals do you have related to your credit?

- Use these credit conversations to guide your credit building work. Keep in mind that survivors might have intense feelings and reactions when working on their credit. Allow the survivor to guide the pace and the direction of the credit building. Normalize their feelings and identify their strengths. Remember that credit goals might change as you work together and that taking care of emergency financial needs will take priority over credit building.

Tip #2 De-mystify credit scores

- When building credit, it helps to understand how the credit reporting agencies and lenders come up with credit scores. Credit scores range from 300-850 and are used by lenders making decisions about whether or not to extend credit and the costs of that credit. Some businesses use credit scores to determine fees associated with their product or service (for example, phone companies, insurance companies) and rental companies and landlords’ decisions about leasing are influenced by credit scores. While there are different types of credit scores (FICO, VantageSCORE, and others) that have their own (secret!) formulas, credit score formulas are based on a few principles:

- Lenders feel safer lending money to consumers who have a history of different types of credit accounts that they pay back, on time. This also benefits consumers who have had a variety of accounts (for example, credit cards, car loans, student loans, mortgages) for a number of years.

- Companies are also looking at how the consumers use the credit that is available to them (not having too much debt) and the number of their new accounts (they want to see a long history of repayment). This disadvantages newer credit users and can be difficult for survivors who are younger, new to the US, or new to using the credit system due to abuse or other factors.

- It can be confusing (and disheartening) for survivors to see that even if they are paying their utility, phone bills, and rent on time, that they might still have a low credit score. This is because most utility and rental companies do not report to credit unless the account is in collections.

- Remind survivors that they are not their credit score! They can be trustworthy, financially savvy, responsible and still have a lower credit score.

Tip #3 Obtaining credit score(s)

- Each consumer in the United States is eligible for one free credit report from each of the “big three” (Transunion, Equifax, Experian) credit reporting agencies (CRAs) each year. For more information on safely ordering a credit report, see CSAJ’s Guidebook.

- There is not currently a consumer right that provides consumers a free credit score (although consumer advocates are working to change that!).

- You can pay for your credit score directly from the CRAs for around $20.00 each. There are also monthly subscriptions to monitor your credit and credit score that vary in price. Consumer advocates are wary of the costs of monitoring services because they argue that consumers can monitor their own credit through the free reports. Some survivors are worried about their partner/ex partner using their credit and want to pay the cost of monitoring. Discuss options like freezing accounts and the pros and cons of credit monitoring.

- See the suggestions below for getting access to your credit score for free:

- If the survivor has a banking institution or a credit card, check if they offer free credit scores as a part of their customer services. When shopping for a bank or credit card, ask about the FICO open access program that allows you to see your FICO score for free.

- Use a free credit score service. Several websites provide free access to your credit score. They are free because they use advertising on their sites, especially for costly credit repair and monitoring services. Some popular options are:

- Credit Karma: Offers free credit scores from Transunion and Equifax

- Credit Sesame: Provides a free credit from from Transunion

- Credit.com: Gives a free Experian credit score.

- Talk about the risks inherent in providing personal information to these websites.

- Look for (and be careful about) free credit score promotions. Many credit monitoring services will offer a free credit score as a part of a free trial period. Be sure to read the terms and cancel before the trial period ends to avoid any charges.

- Build partnerships! Reach out to local banking institutions to create partnerships with your organization. Access to credit reports and credit scores can be a benefit in these partnerships.

Tip #4 Maintain good lines of credit

- For survivors who have current lines of credit, maintaining and building on these lines of credit is key for credit health and financial agency. Please note: when money is tight, survivor’s might need to make tough decisions about who to pay and when. Prioritizing housing, food, medical needs, and other necessities might mean forgoing maintaining good lines of credit while working towards stabilization and safety. For more information on prioritizing debt, see here. See below for tips on maintaining good lines of credit:

- Pay bills on time. Avoid fees for late payments by paying on or before the due date. Companies will report payments made after 30 days late to the CRAs.

- Create a meaningful cost of living plan (budget) that includes a plan for how and when you will use credit cards. Create strategies that help you limit your credit card use.

- Keep balances well below your credit limit.

- Contact companies early on and communicate if you are not going to be able to pay your bill. Determine a payment plan if possible. If the customer service representative is unhelpful, thank them for their time, hang up, and try again!

Tip #5 Discuss credit building options

- For survivors who want to build their credit, discuss credit building tools and examine which option (or options) best fits with their situation. Review the benefits and risks associated with each strategy with the survivor, taking in account the survivors’ credit values and how the credit building strategy could impact their safety.

- Open a secure credit card. A secure credit card requires you to make a deposit up front that acts as a collateral and usually is your credit limit. For example, you put down $200.00 as a deposit and this will be your credit limit. You use the card like a regular credit card. The deposit reduces risk to the company, therefore many people who don’t qualify for a traditional credit card can qualify for a secure credit card. If you manage the card well and close the account in good standing, you get your deposit back.

Some newer “credit builder” cards allow you to have a “credit builder account” attached to your credit card and whatever money you deposit into the account sets your spending limit. There are no credit checks for these accounts.

To use a secure credit card as a credit building tool, determine a set amount or type of purchase to make on the credit card. Pay it back on time, monthly or or twice a month, in the full amount to avoid paying interest. Discuss safe storing and use of the card with the survivor. Pay attention to the annual percentage rate and fees involved with the card and shop around for the card that’s the best fit. - Get a credit builder loan/account. A credit builder account is a special type of loan designed to help you build or improve your credit. You apply for the account at a bank or credit union. Instead of giving you the loan money upfront, the money is held in a special savings account. You make monthly payments toward the loan. These payments are reported to the credit bureaus, helping to build your credit history. Once you’ve made all the payments, the money in the savings account (which is the loan amount) is released to you.

The credit builder loan may be a good option for people who want to build their credit and who have some money to pay each month but don’t feel safe having a credit card. Usually you don’t need to pass a credit check to get the “loan”. You can find credit builder accounts at credit unions, banks, and online banks. Credit unions often have the best terms.

Some non-profits offer credit building accounts often called microloans. For example, NNEDV’s Independence Project offers a short term, no-interest, no-fee credit-building microloan specifically for survivors of IPV. Survivor’s get a microloan for $100.00 and pay $10.00 a month. Click here for more information about the program requirements. Your community might also have microloans through area non-profits. Explore!

- Use a cosigner. When survivors can’t qualify for a loan on their own, some might consider using a co-signer who has higher credit to help them get the loan. A cosigner can be helpful but must be used cautiously because it can cause tension in the relationship and the survivor might feel like they “owe” the cosigner or might worry about the consequences of not being able to pay back the loan, which will negatively affect the co-signer. Discuss who might be a good option as a cosigner and the pros and cons of using this strategy.

- Explore alternative credit boosting programs. Consider credit building programs that report on time bill pay to a credit bureau as a way to increase credit scores. There are a variety of such services including Altro, eCredable, and UltraFICO score with more likely coming soon. Let’s explore one popular credit boosting service, Experian Boost. Experian Boost is a free service that links to your bank accounts where you pay your bills and reports on-time payments for utilities, phone bills and services in your Experian credit report. Privacy concerns exist because the program requires you to give Experian and their financial partners your bank account information. These concerns might be heightened for survivors who are being surveilled by a partner or ex partner. This service is not available to survivors who use in person bill pay or money orders to pay their bills.

Experian reports that the average ExperianBoost user increases their Experian credit score by 8-13 points. Depending on the survivor’s credit needs, this might not make a substantive difference in their ability to access credit at a reasonable cost. Additionally, survivors need to be aware that this will increase their Experian credit score, but will not impact other credit scores that might be used by lenders and as of this writing, will not help with mortgage lenders. - Build non-traditional credit. Immigrant survivors, survivors who are being technologically stalked/surveilled, and survivor’s who are looking for alternative ways to build credit, can consider building a non-traditional credit “file” by keeping documentation of proper payments to utilities, rent, childcare providers, medical providers, or other payments you make on a regular basis. A year of on time pay history from three of more accounts might help loan officers and landlords look beyond your credit score. Some lenders will write a letter of credit reference with a positive bill pay history. Save receipts, invoices noting “paid in full” and other documentation. Anecdotally, advocates and survivors have noted more success using non-traditional credit with independent landlords than with larger management companies.

Navigating the ever-evolving credit system can be challenging and advocates are key to this process. Please contact CSAJ with questions about credit building and other credit advocacy.

References:

Consumer Debt Advocacy Toolkit: Debt Advocacy

Dieker, N. (2021). Why are there different types of credit scores? Bankrate.

How to rebuild your credit. CFPB

Johnson, H.D. (2023). Is Experian Boost Worth It? Bankrate.

Milliken, M. (2024). How to Establish Credit with No Credit History.

National Consumer Assistance Plan

The United Way : Building a Non-Traditional Credit Report

2.2 Organizational and systems advocacy

Building strong relationships with community organizations and local court systems can significantly enhance support for immigrant survivors. Some key strategies could include:

1. Ensuring Proper Interpretation Services

This can include:

- Building relationships with court personnel to remind them to schedule interpreters and allot enough time for hearing,

- Compensating bilingual advocates, and

- Providing trauma-informed training for interpreters to ensure accurate and sensitive communication

2. Promoting Language Access: Language barriers can prevent survivors from accessing vital services. Advocates can support policies that encourage language access legislation.

3. Developing Financial Literacy Programs: Financial literacy is essential for economic stability. Community organizations can:

- Partner with local banks to provide financial literacy programs tailored to the needs of immigrant survivors.

- Identify safe places for financial transactions, such as purchasing money orders and cashing checks.

4. Establishing Creative, Immigrant-Led Solutions: Immigrant communities often develop innovative solutions to economic challenges. Examples include:

- Lending circles, where members pool money and take turns accessing the funds, fostering mutual support and financial stability.

- Community garage sales and art shows, where proceeds are shared with survivors.

- Micro-lending programs, such as those that provide short-term, no-interest microloans to survivors.

5. Sharing Accurate Information: Accurate information sharing within communities is vital. Misinformation can exacerbate fears and barriers to accessing services. Advocates should:

- Ensure that survivors receive correct information about their rights and available resources.

- Use mapping tools from organizations like CSAJ to identify and share safe, trusted local resources.

6. Building Partnerships: Creating partnerships between consumer lawyers, immigrant lawyers, and family lawyers can enhance the support network for survivors. These partnerships can help:

- Navigate complex legal and financial systems.

- Advocate for survivor rights and access to economic resources.

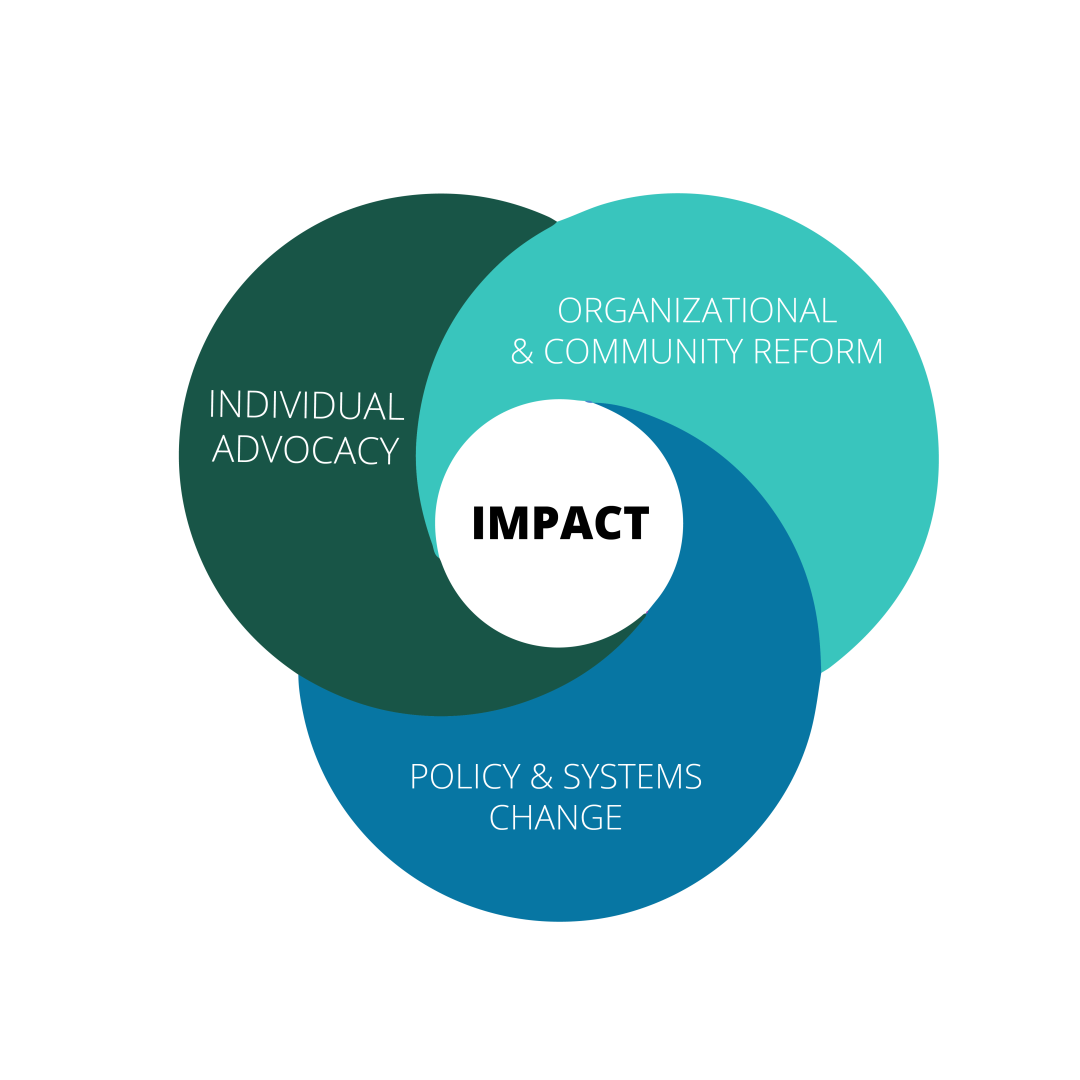

A comprehensive approach combining individual advocacy, organizational support, and creative community solutions can significantly improve the economic stability and well-being of immigrant survivors of domestic violence. By addressing language barriers, promoting financial literacy, and building strong partnerships, advocates can help survivors overcome economic challenges and achieve lasting security.

Section 3: Policy Spotlight

CSAJ’s National Coerced Debt Working Group (CDWG) is comprised of attorneys, advocates, researchers, and policy makers from across the nation who pool their diverse expertise at the intersection of debt and domestic violence. The CDWG meets quarterly to advance systems and policy change to address coerced debt at the federal level and in states across the country. The following are key accomplishments and updates.

- In August, CSAJ and NCLC filed a petition with the Consumer Financial Protection Bureau asking for rulemaking on the Fair Credit Reporting Act to address the issue of coerced debt. The petition advocates for four rules changes: change the definition of identity theft to include any debt incurred without effective consent; change the definition of identity theft reports to include the broader definition of identity theft (without effective consent); allow survivors to block information related to coerced debt; and prohibit credit reporting agencies from refusing to block information related to coerced debt. The petition can be accessed here. The CDWG also organized and submitted a collective comment.

- This past April, the Department of Housing and Urban Development issued Guidance on Application of the Fair Housing Act to the Screening of Applicants to Rental Housing. The guidance discusses the problematic impact of certain tenant screening practices on domestic violence survivors. For example, the guidance states the following with respect to use of credit history: “Survivors of domestic violence, who are disproportionately women, are also more likely to have had experiences resulting in no or low credit scores. A survivor might not have credit records because their partner prohibited them from opening their own accounts, or the survivor might have negative credit history from being forced to obtain credit for the perpetrator’s benefit or assume the perpetrator’s unpaid bills. Because of these disparities, overbroad screenings for credit history may have an unjustified discriminatory effect based on race or other protected characteristics.”

- Connecticut passed its first coerced debt legislation, and it was signed into law in May. CT Public Act 24-77 – https://cga.ct.gov/2024/ACT/PA/PDF/2024PA-00077-R00SB-00123-PA.PDF. The bill, effective January 1, 2025: provides detailed definitions of terms related to the process of identifying and waiving coerced debt; prohibits the intentional incurring of coerced debt; and establishes civil liability for violators. It mandates that creditors halt all collection activities upon receiving certified information from the debtor about the coercion until a review is completed. The bill also pauses the statute of limitations during the review and limits debtors to one waiver request per debt. It does not mandate refunds for payments on debts later identified as coerced, nor does it affect the rights of claimants to recover from the individuals responsible for the coercion or other legal rights or defenses. The bill was approved on May 30, 2024.

- In January, the Mapping and Advancing Equity Project released a National Survivor Equity Policy Platform in January. In May, ninety-six advocates and survivors joined a 2 part Innovation Exchange, which shared the Report and spoke to the values, people, and process. Over the next two years, the Survivor Advocate Advisory Board will convene working groups to implement three priority areas: coerced debt relief, thriving wages for the GBV field, and direct cash assistance for survivors.

Other Policy Updates:

- The CFPB recently issued new and updated glossaries of financial terms in Arabic, Chinese, Haitian Creole, Korean, Russian, Spanish, Tagalog, and Vietnamese!

- On April 1, a federal court ordered the bond services company Libre by Nexus, Inc., its parent company Nexus Services, Inc., and individual defendants to pay an $811 million judgment for targeting immigrants and their families with deceptive and abusive tactics. The CFPB, together with the Attorneys General of Virginia, Massachusetts, and New York, filed the lawsuit in 2021, alleging that the defendants operated a scheme through which they lured immigrants in federal immigration detention, and their families, into debt traps by forcing them to sign abusive, English-only contracts that bound them to years of exorbitant monthly payments in order to secure bonds for release from detention. The court ordered payment of $231 million in restitution to affected consumers, and entered $580 million in civil money penalties to be paid to the CFPB, Virginia, Massachusetts, and New York. The court also enjoined defendants from, among other things, collecting and retaining monies in connection with contracts for immigration services prior to the date of the judgment, and required them to take affirmative steps to ensure consumers are provided with clear, linguistically accessible information about their products and services. Defendants are appealing the judgment in the Fourth Circuit. Consumers who are eligible for redress under this judgment should retain records or supporting documents of their payments to Libre. When appropriate, the CFPB will administer redress and will provide updated information to affected consumers.

- On April 10, the Financial Literacy and Education Commission (FLEC) held a public meeting that featured a panel on access to financial services for New Americans, including immigrants and refugees, as well as a spotlight discussion on access to financial services and products for Muslim and Arab Americans. The FLEC is made up of 24 federal agencies and is chaired by the Secretary of the Treasury and the vice chair is the Director of the Consumer Financial Protection Bureau. The April meeting included a range of valuable experiences and views shared by diverse presenters. Check out the recording here and the agenda here.

- New T Visa Regulation Includes Freedom Network USA Recommendations that Protect Survivors. This new rule will allow survivors to safely work and rebuild their lives during the growing wait times for a visa. See Rule below: https://www.federalregister.gov/documents/2024/04/30/2024-09022/classification-for-victims-of-severe-forms-of-trafficking-in-persons-eligibility-for-t-nonimmigrant?utm_campaign=subscription+mailing+list&utm_medium=email&utm_source=federalregister.gov

Section 4: Additional resources

- CSAJ resources

- CSAJ Newsletter 2023 pt 2

- CSAJ Consumer Advocacy Guide -The Economic Ripple Effect Facing Immigrant Survivors

- Recording for the April 19th 2024 Legal Roundtable on The Economic and Consumer Rights for Immigrant Survivors of Domestic Violence – English recording 4-19 CSAJ Roundtable_captioned

- Helpful websites with great information on immigrants access to economic options

- National Immigrant Women’s Advocacy Project: https://niwaplibrary.wcl.american.edu/

- ASISTA Immigration Assistance: https://asistahelp.org

- Protecting Immigrant Families: https://pifcoalition.org/

- National Immigration Law Center: https://www.nilc.org/

- National Housing Law Project: Immigrant Rights: https://www.nhlp.org/initiatives/immigrant-rights/

This project is supported all or in part by Grant No. 15JOVW-22-GK-04011-MUMU awarded by the Office on Violence Against Women, U.S. Department of Justice. The opinions, findings, conclusions, and recommendations expressed in the publication/program/exhibition are those of the author(s) and do not necessarily reflect the views of the Department of Justice, Office on Violence Against Women.