Coerced debt is a form of economic abuse where an abusive partner uses, exploits, and or damages credit for their own advantage and to restrict a survivor’s autonomy and agency.

Nearly all survivors experience some form of economic abuse (99%), and half report that they have experienced coerced debt. Coerced debt creates an economic ripple effect that compounds over the life course, creating financial devastation and placing survivors at increased risk of violence. Survivors are saddled with overwhelming debt burdens with 50% of survivors reporting debt loads up to $20,000, 23% over $20,000, and 26% don’t know how much. Beyond the hard costs, coerced debt creates a cascade of consequences by damaging credit and thus restricting access to housing, employment, utilities, and other basic material resources. 46% percent of survivors report their credit was hurt by the actions of an abusive partner, and unfortunately, survivors have limited legal protections from coerced debt.

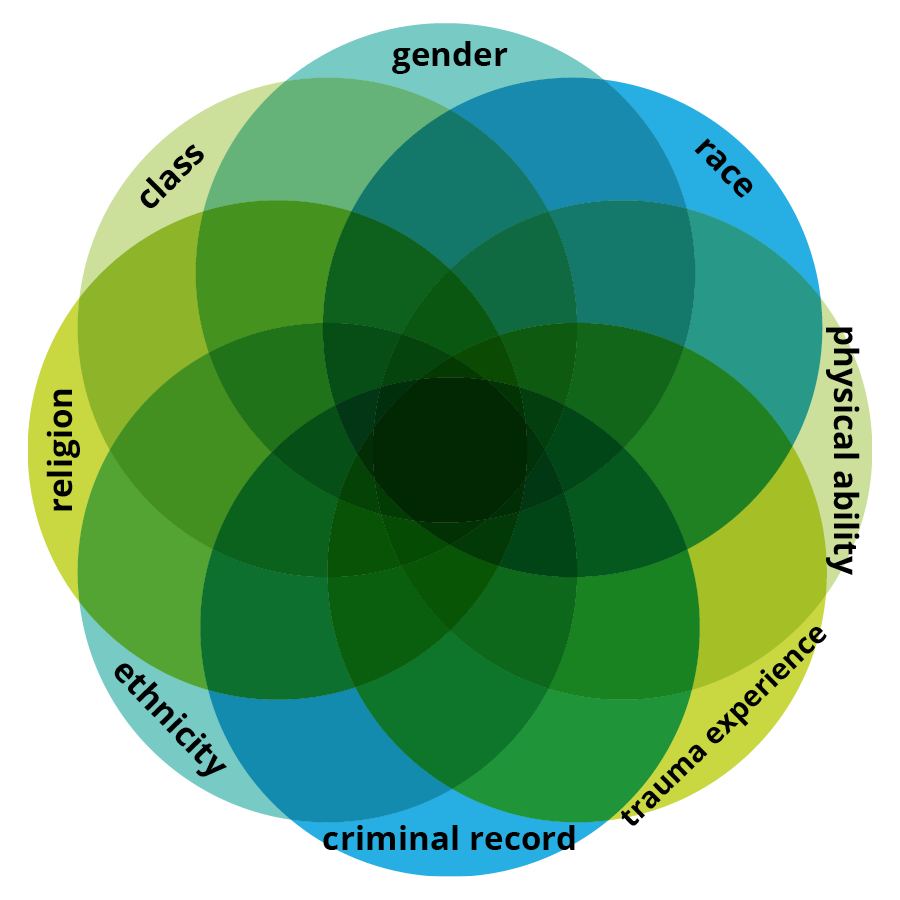

Unsurprisingly, a deregulated system is stacked against BIPOC communities who are disproportionately targeted and impacted by the debt collection industry. As a result, coerced debt compounds other financial hardships, creating long-term financial problems and limiting survivors’ options for safety.

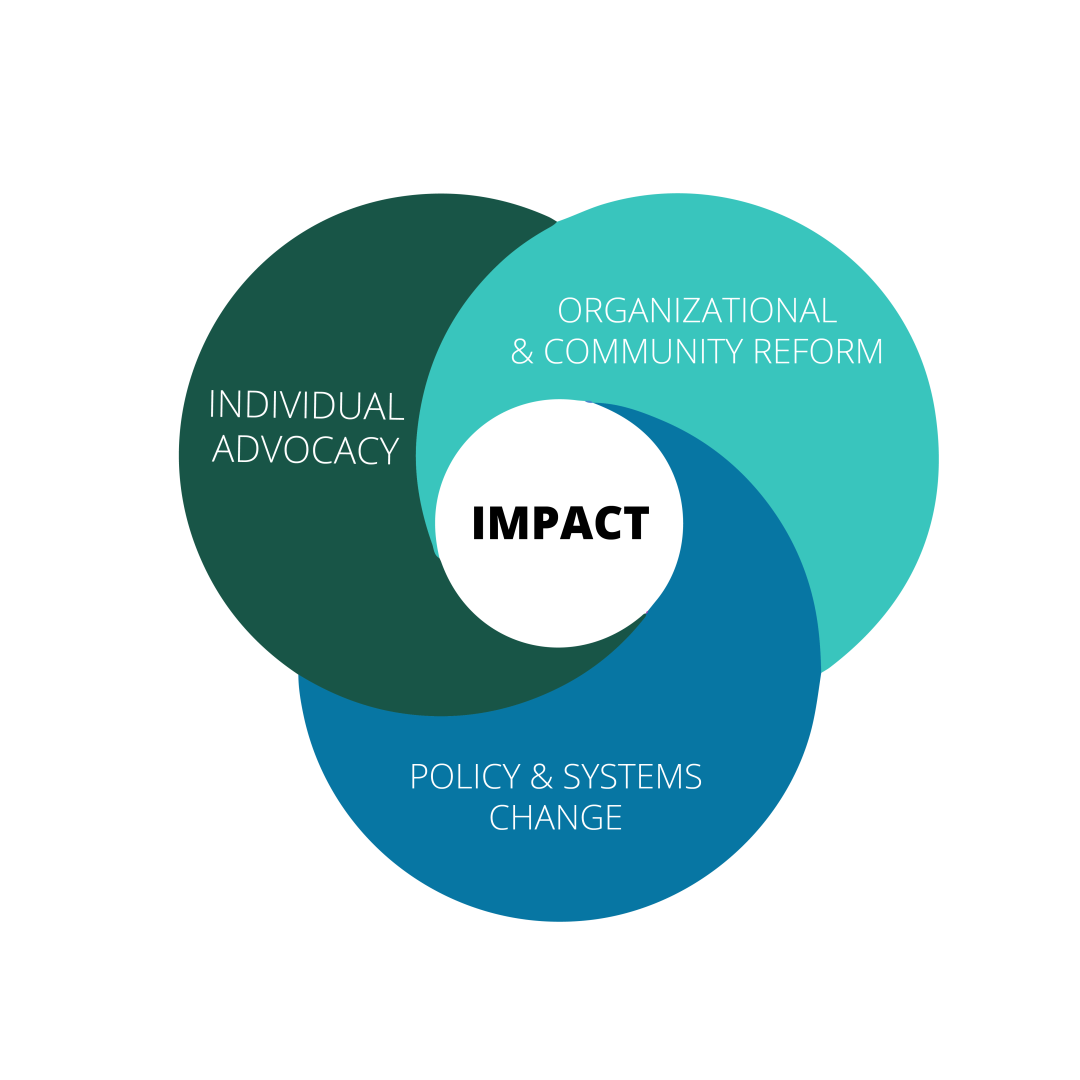

The purpose of this Coerced Debt Landscape is to share data that helps tell the story of:

- The prevalence of coerced debt survivors’ experience

- Existing advocacy supports and resources available to survivors that experience coerced debt from the domestic and sexual violence field

- Which states have coerced debt relief or policy remedies available to survivors

- Advocate and survivor experiences with navigating the coerced debt landscape

“Our rural agency does not have legal or specialized expertise to help survivors navigate the process of disputing coerced debt. We work with clients for a limited amount of time, typically three months or less, and the process of disputing coerced debt takes much longer than that. It’s difficult for survivors to find reputable, affordable options for help. A survivor came to our shelter and paid a debt consolidation company more money than the actual amount of the debt itself. Because she had a mild intellectual disability, they were easily able to convince her that they were providing her a worthwhile service by taking her monthly payments, however not a single penny of the money she paid went to the debt itself.”

– Nevada advocate quote from 2025 CFPB National Survey on Barriers to Disputing Coerced Debt.

Coerced Debt

Note: Dashboards are best viewed on a desktop or laptop computer in full screen mode. The layout and functionality may distort to fit smart-phone screens.

View Methodology & Documentation for a list of all terms, data, and data sources for each Safety Landscape.

- Full-screen mode: If the embedded dashboard below is hard to view, click the “expand” icon in the lower right corner of the window to view in full screen mode.

- Click the download icon (bottom-right): To download a PDF, image, or PowerPoint slide of the dashboard. Ensure you’ve selected the data point via all five dropdowns and the view you want. Bring this to meetings, share with partners, add your own data to supplement, and use it in your advocacy!

- Looking at the coerced debt indicators, what stands out to you? Are survivors likely to be burdened with coerced debt in your state?

- Does your state have better or worse with coerced debt outcomes? Does this match what you know about survivors’ experiences with coerced debt ?

- What other data would help paint the picture of survivors’ coerced debt inequities? Can you find it in other “safety landscapes,” pull from your own program data, or is it something that needs to be gathered?

- What’s upstream from the coerced debt picture painted here? What policies, funding, or other forces play a role in?

- How do survivors in states with coerced debt relief fare compared to those without?

- What does coerced debt advocacy and service provision look like in your state?