The Center for Survivor Agency and Justice (CSAJ) condemns the Supreme Court’s decision in Relentless, Inc. v. Dept. of Commerce and Loper Bright Enterprises, Inc. v. Raimondo, which undoes decades of important regulatory law. For survivors of gender based violence, the ruling threatens to heighten the economic barriers they already face, placing them at acute risk of danger.

In Loper, the Supreme Court dismantled long-standing, legal precedent that protected individuals, by overturning Chevron v. Natural Resource Defense Council, which had required that courts give deference to the regulatory expertise of federal agencies. The Loper decision makes legal challenges to regulations easier and may well dissuade agencies from issuing regulations in the first place. In doing so, the Court has effectively constrained the power of federal agencies to interpret statutes that have the potential to impact every corner of survivors’ lives. Indeed, the risks posed by Loper are as wide ranging as the reach of the executive branch– from Housing and Urban Development, to Health and Human Services, to the Department of Labor, to the Federal Trade Commission, to the Center for Disease Control, to the Department of Education, to the Department of Justice, to the Consumer Financial Protection Bureau and beyond. As such, the Supreme Court’s ruling has vast and devastating repercussions.

In particular, given CSAJ’s work with and as survivors of gender based violence across the nation, we shudder at the implications Loper poses to survivors’ access to consumer and financial protections.

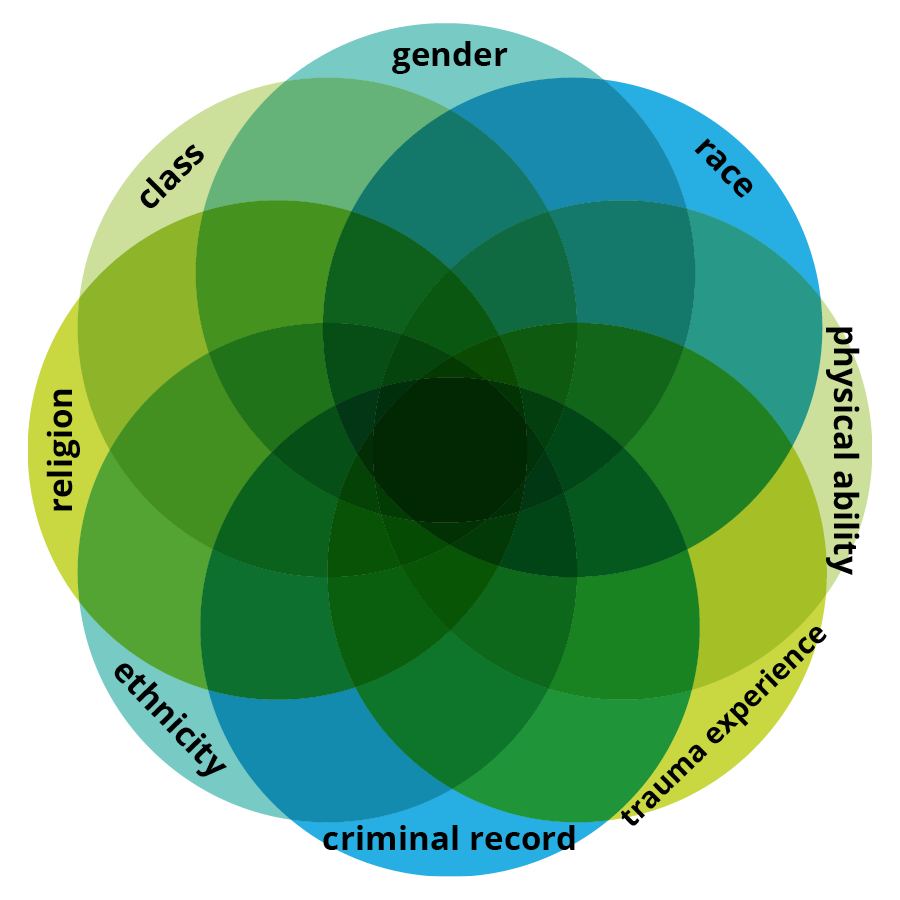

There is no safety for domestic violence survivors without economic security. Domestic violence leads to economic hardship, and economic hardship in turn leads to increased vulnerability to violence. Almost all (99%) of domestic violence survivors report that they experience economic abuse1, which results in an economic ripple effect that creates lifelong barriers to safety.2 People marginalized by race, ethnicity, sexual orientation, immigration status, and ability are disproportionately subject to poverty due to historic and current day structural inequities. With unequal access to economic resources, survivors from marginalized communities have fewer options for safety and are, therefore, substantially (almost two times) more likely to experience violence.3

Since its inception, the Consumer Financial Protection Bureau has played a critical role in ensuring that vulnerable populations are protected from the abuse of both individuals and financial institutions. Seventy percent of domestic violence survivors experience some form of debt and approximately 52% of survivors experience coerced debt4– nonconsensual, credit related transactions that occur in a violent relationship, that an abuser takes out in a survivor’s name without their knowledge or consent (fraud) or debt that they pressure, threaten, or manipulate a survivor into taking out in their own name (coercion). Coerced debt leads to negative credit, which creates a cascade of economic consequences– barriers to housing, employment, and utilities– that have immediate and profound impacts on survivors’ access to safety. These credit impacts take place in the context of stunning racial disparities, which compound to cause increased vulnerability for survivors of color. For years, CSAJ has advocated with the CFPB to ensure that survivors are protected from the impacts of economic abuse and coerced debt, through regulations and rulemaking on federal legislation, such as the Fair Credit Reporting Act. To continue this vital work, the CFPB’s expertise should be recognized so that it can exercise its full power to regulate individual harm-doers, creditors, credit agencies, and financial institutions to ensure that domestic violence survivors are not held liable for debt they did not incur and to ensure that our financial systems account for the role that they play in protecting survivors’ economic and physical safety.

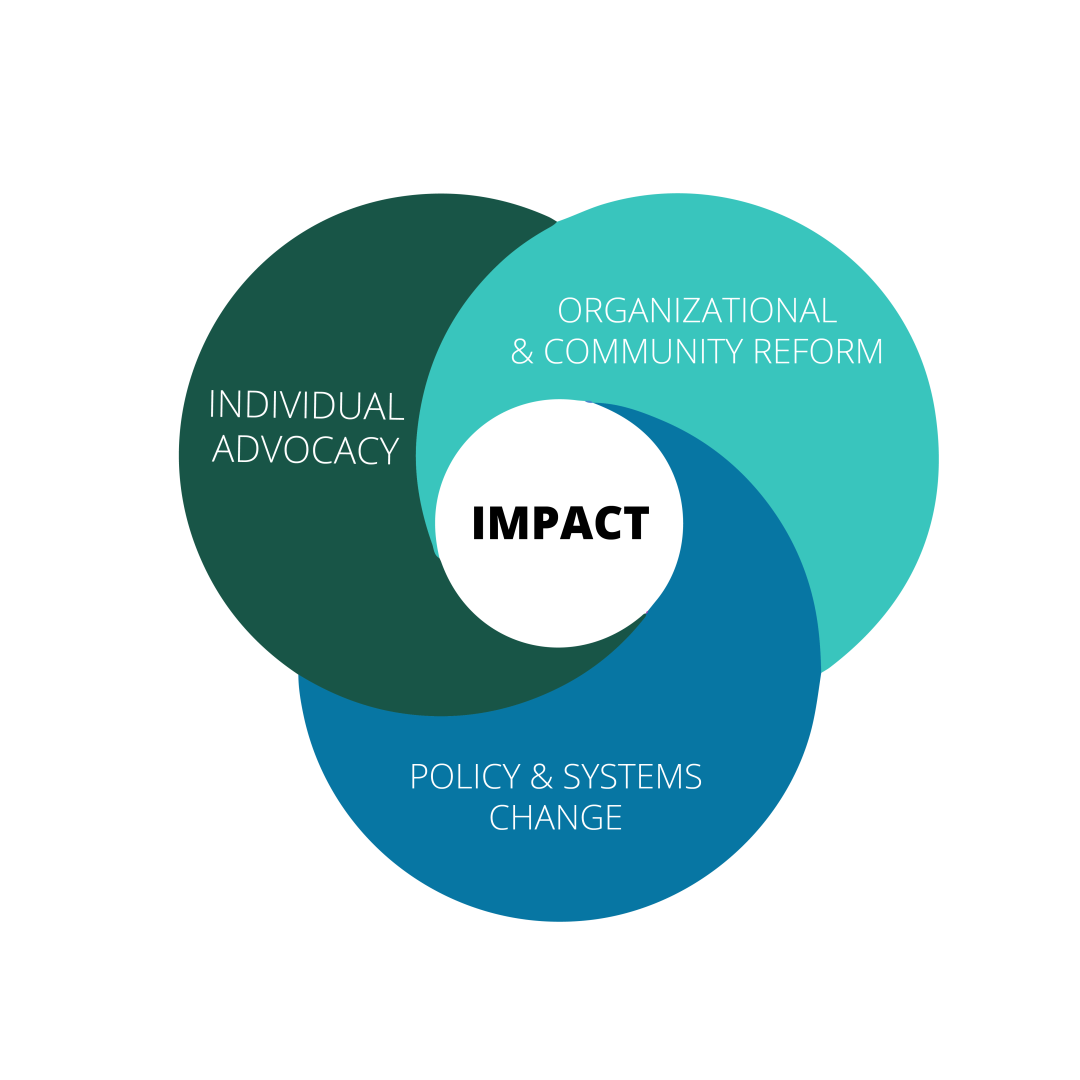

By limiting the regulatory power of the CFPB and other federal agencies, Loper places domestic violence survivors and marginalized communities generally at increased risk of economic devastation, potentially depriving them of the critical resources needed for safety. Despite the damaging constraints that the Court has placed on federal agencies, and with concerns about its dangerous impact, CSAJ rejects the Court’s holding as we redouble our efforts to advocate for systems changes that address coerced debt and the economic and physical safety needs of survivors at the margins.

- Adams, A. E., Sullivan, C. M., Bybee, D., & Greeson, M. R. (2008). Development of the Scale of Economic Abuse. Violence Against Women, 14(5), 563-588. ↩︎

- Sara J. Shoener & Erika A. Sussman, Economic Ripple Effect of IPV: Building Partnerships for Systemic Change, Domestic Violence Report 83-95 (August-September 2013), https://csaj.org/wp-content/uploads/2021/10/Economic-Ripple-Effect-ofIPV-Building-Partnerships-for-Systemic-Change.pdf (last visited Sept. 8, 2022). ↩︎

- See sources for disparities in intimate partner violence and poverty by race and other identity factors in CSAJ’s Accounting for Economic Security Atlas (pgs 38 and 40): https://csaj.org/wp-content/uploads/2021/10/Accounting-for-Survivors-Economic-Security-Atlas-Mapping-the-Terrain-.pdf ↩︎

- CSAJ’s National Survey on Survivor Economic Wellbeing (2019). ↩︎