Consumer Rights for Domestic & Sexual Violence Survivors Initiative

Newsletter on Coerced Debt

Also available here.

CSAJ’s Consumer Rights Newsletters share multi-level strategies by and for the field to enhance survivors’ economic security. In this edition, we feature strategies for advocacy, partnership building, and systems change that address Coerced Debt facing survivors.

Interested in additional technical assistance, training, or collaborating more closely with CSAJ’s Consumer Rights Initiative? Contact Us!

Consumer Issues Facing Survivors: Why They’re More Common Than You Think!

Survivors of violence face profound and long-term economic harms from both abuse and poverty. There is no safety without economic security.©

Many of these economic harms are known as “consumer rights issues,” and are things like: credit reporting and repair, debt collection defense, credit discrimination, student loans, economic relief in family law, bankruptcy and foreclosure prevention and defense, and tax relief (including innocent spouse relief). And they often overlap with economic barriers in civil court, economic barriers to housing and employment, and addressing barriers to accessing other economic opportunities.

Consumer Rights Advocacy includes a range of legal and nonlegal advocacy strategies that can equip survivors with critical information and tools to address these economic harms and thus increase their options for safety.

Read more about the “Economic Ripple Effect of Domestic Violence” and the power of consumer law and survivor-centered advocacy.

What is Coerced Debt?

Definitions: Coerced Debt occurs in the context of coercive control, and includes both fraud and coercion.

- Coercive Control: The systematic, ongoing use of violence, intimidation, isolation, and control to restrict the survivor’s autonomy and liberty. Littwin, 2012; Stark, 2007

- Economic Abuse: “Behaviors that control a person’s ability to acquire, use, and maintain economic resources, thus threatening their economic security and potential for self-sufficiency.” Adams, Sullivan, Bybee, & Greeson, 2008.

- Coerced Debt: An abusive partner generates debt in their partner’s name through discrete transactions involving coercion or fraud and creates an environment in which refusing a demand or questioning their behavior is dangerous. Littwin, 2012; Stark, 2007

- Fraud: Using a survivor’s personal information to take out credit in their name without their knowledge. Littwin, 2012

Coercion: Using demands and threats to force a survivor to take on debt they would not have otherwise incurred. Littwin, 2012

Key stats: By the Numbers

- NEARLY ALL: In her ground-breaking research, Adrienne Adams and colleagues found that nearly all (or 99%) survivors experienced some form of economic abuse from a partner. That rate was higher than those who experience physical violence. Adams, Sullivan, Bybee, & Greeson, 2008.

- THREE IN FOUR: In a new study of survivors who called the National Domestic Violence Hotline, 71% (nearly 3 in 4) reported that their partners kept or hid financial information from them. Adams, Littwin, & Javorka (in press)

- ONE IN TWO: Nearly half (43%) of survivors reported being pressured to take out credit in their own name when they did not want to. And 52% reported that an abusive partner put debt in their name through a fraudulent or coercive transaction. Adams, Littwin, & Javorka (in press)

- What’s the Harm? 46% of survivors in the study reported their credit report or credit score was hurt by the actions of an abusive partner. 73% stayed longer than they wanted in an abusive relationship because of financial concerns. 63% discovered the harm because they were contacted by a creditor or bill collector. Adams, Littwin, & Javorka (in press)

Resources:

- The Scale of Economic Abuse (Adams, Sullivan, Bybee, & Greeson, 2008): Offers a validated scale to identify the ways abusive partners control and/or exploit survivors’ finances and economic lives: from controlling their income to creating debt in their name to causing them to get fired from a job. Access here.

- The Frequency, Nature, and Effects of Coerced Debt Among a National Sample of Women Seeking Help for Intimate Partner Violence (Adams, Littwin, Javorka, In Press). New research from a sample of women calling the National Domestic Violence Hotline that illustrates how coerced debt occurs and points to lasting impacts. Contact us to request access to this research (not yet published).

Enhancing Individual Advocacy

In June, CSAJ hosted a series of webinars on Coerced Debt. View the complete Coerced Debt Training Toolkit online. Below are insights from attendees about some critical strategies for advocacy along with quick tips and more resources:

“Asking the right questions can help determine if the victim is/was financially abused.”

- Assessing for coerced debt requires asking open ended questions about credit and partner involvement. Each chapter of CSAJ’s Guidebook on Consumer & Economic Civil Legal Advocacy for Survivors offers specific screening and assessment questions.

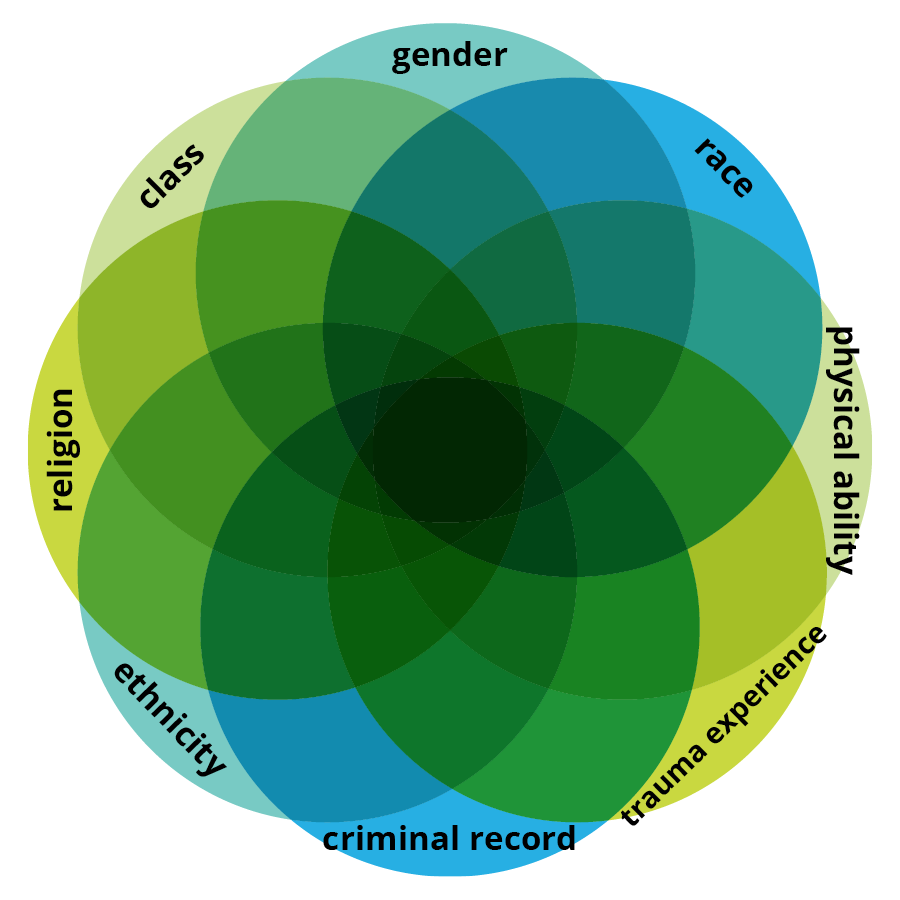

- Advocacy Overview: Survivor defined coerced debt advocacy centers the survivors’ goals, values, multiple identities and strengths while assessing for a broad range of safety needs and risks. It requires constant attention to the survivor’s identified broad array of safety concerns, assessing for safety and crafting detailed, specific thoughtful, creative strategies to reduce risks while attending to issues of power and oppression. See Part 1 of the webinar series, (recording & PPT), as well as an Advocacy Brief on Multilevel Survivor Centered Economic Advocacy for more here.

“[I learned] the specifics of the differences between coercion and other types of fraudulent activities with finances” and “advocating in defense of accrued debt for clients is now a little easier.”

- Making the Distinction: If a client’s abusive partner opened or made charges on an account without the survivor knowing, the client has more remedies to defend against the debt. Knowledge is the key distinction.

- See Part 1 of the webinar series, (recording & PPT), as well as CSAJ’s Guidebook Chapter on Debt and Debt Defense.

Attendees learned other important strategies too, such as, “How to approach reviewing a credit report with a survivor,” “That free credit reports are available,” and finding “alternatives to law enforcement reports for identity theft.

- Consumers are eligible to one free credit report from each of the “big three” credit reporting agencies. Additional reports are available for victims of Identity Theft (if the id theft is reported to police), if consumers are denied credit, are unemployed or receive public benefits.

- Think About It: Reviewing the survivor’s credit report is an important part of coerced debt advocacy. Be aware that current information appears on a credit report and could put a survivor who is being stalked in greater danger. See CSAJ’s Guidebook Chapter on Credit Reporting & Repair.

- Did you know? Consumer judgments are no longer reported on the big three credit reports, which is good for credit scores but can make it difficult to determine if there is an outstanding judgment.

- The National Consumer Assistance Plan: Advocacy Brief The National Consumer Assistance Plan: Advocacy Brief describes recent credit reporting rules, with important information and resources for advocates and attorneys.

Building Partnerships

Tips for Thinking About Partnership Building:

Review the Partner Mapping Worksheet with notes from discussion between Expert Advisor, Katie VonDeLinde, and webinar attendees. Some other tips:

- Explore and identify who in your community is doing innovative work around credit issues and reach out to them. Would they like to do a cross training?

- Convene a credit advocacy and awareness meeting in your community with a variety of partners. Share information and resources.

- Be curious about the credit work others are doing, humble in your approach to partnering, while valuing what you bring to the credit advocacy “table.”

Spotlighting Innovative Consumer & Economic Justice Work:

Highlighting examples of building partnerships within our organizations and between domestic violence and consumer rights advocates.

- Texas Rio Grande Legal Aid, Survivor Centered Economic Advocacy Project: Learn how TRLA used relationships and partnership building strategies to implement their comprehensive and survivor-centered project within a large legal aid agency. (Spotlight coming soon!)

- The Domestic Violence & Consumer Law Working Group (DVCLARO), New York City: Learn how domestic violence and consumer attorneys came together – and learned from survivors – to offer consumer legal advocacy to survivors throughout New York City. View first 20 minutes of Part 2 of the webinar series.

Planning for Systems Change

Tips for Addressing Big Issues:

Webinar attendees brought up some important issues and barriers to addressing coerced debt. Our Consumer Rights Working Group members weigh in:

- Obtaining police reports for identity theft: Identity theft police reports are needed to place an extended fraud alert on credit reports. Some companies may also require a police report for disputes on payments. Consider talking to your local police department about how they handle these issues and engage in conversations about identity theft issues for survivors of IPV and SA before advocating for a specific client. If a client does not want to, or cannot, obtain a police report, consider looking at a credit freeze.

- Did you know survivors can get free access to their credit scores at sites like credit karma or credit sesame? Many sites will give you your score for free, but look out for services that cost money, like becoming a “member”. To increase client safety and privacy, organizations can partner with financial institutions that can do “soft pulls” to obtain client credit reports (with signed releases and permission) without needing to update the client’s private information in the credit reporting database.

- Are there other things you’ve done? For example, what are good strategies to repair survivors’ credit reports? What other credit or debt advocacy are you doing? What resources do you use? What resources to you need? [Let us know](mailto:info@csaj.org] so we can share-back with the field!

Models, Tools & Resources for Change:

- NEW! Report by the Domestic Violence and Consumer Law Working Group (DVCLARO), “Denied: How Economic Abuse Perpetuates Homelessness for Domestic Violence Survivors.” DVCLARO is a collaborative working group of advocates in New York City, recently conducted a survey on the connection between debt and homelessness for survivors. They used the findings to make policy and practice recommendations at the City and State level. Also, review this Action Planner Worksheet to see how they approached the work. What can you learn? What might look different for you, given your context and needs?

- Strategic Action Planning Worksheet: How do you ask questions about current laws/policies if you don’t know much about them? How can you bring this understanding to the partnerships and collaborations you are a part of? Use this worksheet as a tool to help you identify and ask the right questions, and engage with your partnerships about how current laws and policies impact survivors’ economic realities.

- Find out about CSAJ’s other systems advocacy work on our Resource Library.

- Do you have an idea for systems change, or want to share an innovative practice? Contact Us!

CSAJ’s Consumer Rights Working Group

Comprised of Organizational Partners and Expert Advisors from across disciplines and across sectors, the working group meets quarterly to discuss and disseminate best practices in survivor centeres economic advocacy.